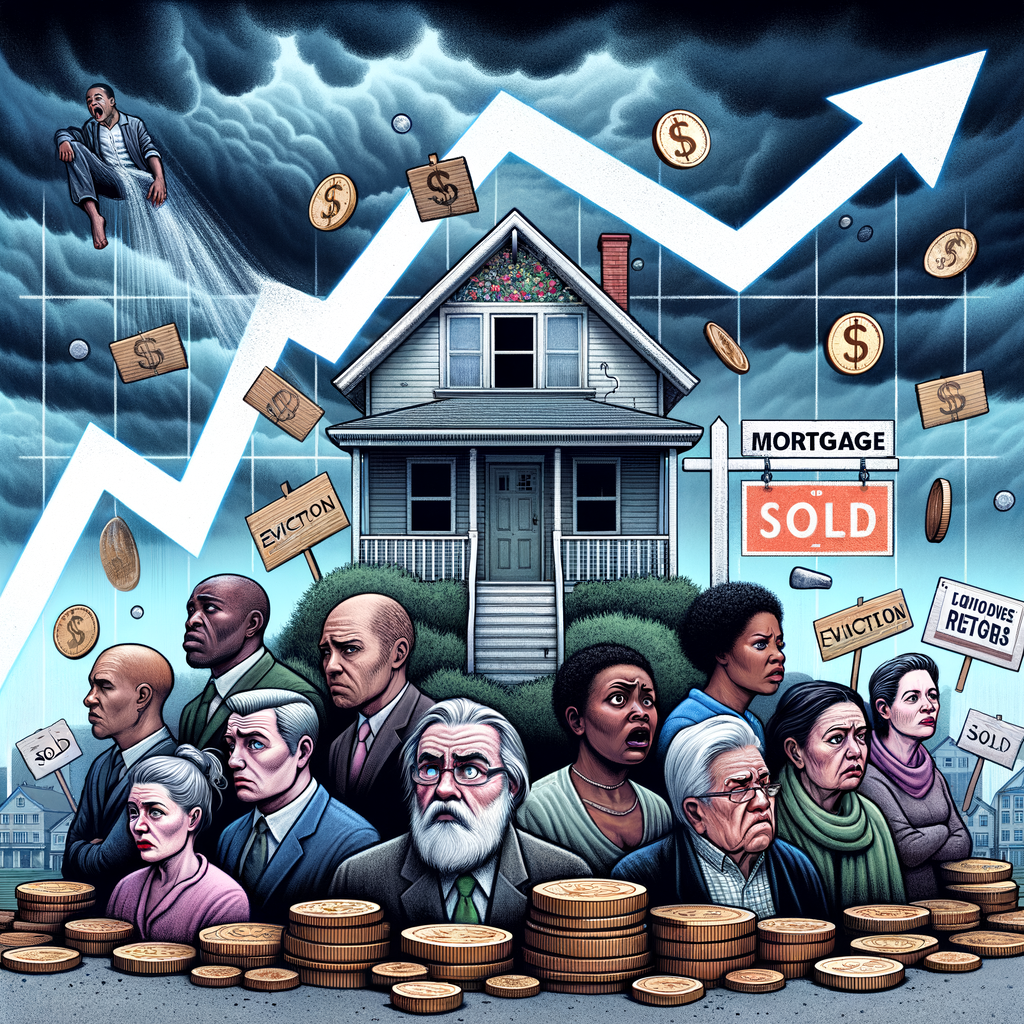

As the US housing market crisis deepens, homeowners across the country are feeling the impact of rising mortgage rates. The once-booming real estate industry is now facing unprecedented challenges, with many struggling to keep up with their monthly mortgage payments. In this article, we will delve into the reasons behind the current housing market turmoil, how rising mortgage rates are affecting homeowners, and what can be done to navigate these turbulent times.

The Rising Mortgage Rates Phenomenon

In recent months, mortgage rates in the US have been on the rise, reaching levels not seen in years. This upward trend is primarily driven by the Federal Reserve’s decision to gradually increase interest rates to combat inflation and stabilize the economy. As a result, the cost of borrowing for homebuyers has increased, leading to higher monthly mortgage payments for existing homeowners with adjustable-rate mortgages.

Implications for Homeowners

For homeowners with adjustable-rate mortgages, the rise in mortgage rates can spell trouble. Monthly payments that were once affordable may now be out of reach, putting homeowners at risk of falling behind on their mortgage payments. As a result, many are facing the prospect of foreclosure or having to sell their homes at a loss.

Even homeowners with fixed-rate mortgages are feeling the pinch. While their monthly payments remain stable, the overall cost of homeownership has increased. Higher mortgage rates mean that potential buyers are less likely to enter the market, leading to a decrease in home values and potential difficulties in selling properties.

Strategies for Homeowners

In the face of rising mortgage rates, homeowners are advised to take proactive steps to protect their investment and financial well-being. Here are some strategies to consider:

1. Refinancing: Explore the option of refinancing your mortgage to lock in a lower interest rate. While this may involve upfront costs, it could result in significant savings over the life of the loan.

2. Budgeting: Review your monthly budget to identify areas where you can cut back on expenses to accommodate the higher mortgage payments. Prioritize essential expenses and consider ways to increase your income to cover the additional costs.

3. Seeking Assistance: If you are struggling to make your mortgage payments, reach out to your lender to discuss possible solutions. They may offer forbearance or loan modification options to help you stay current on your mortgage.

4. Selling or Downsizing: In some cases, selling your home or downsizing to a more affordable property may be the best option to avoid financial hardship. Consider working with a real estate agent to assess your options and make an informed decision.

The Road Ahead

While the US housing market crisis is causing turmoil for many homeowners, there is hope on the horizon. The Federal Reserve has indicated that it will continue to monitor economic conditions and adjust interest rates accordingly to support a stable housing market. Additionally, government programs and initiatives may be implemented to assist struggling homeowners and prevent widespread foreclosures.

In conclusion, the rising mortgage rates in the US housing market have created challenges for homeowners, requiring them to be proactive in managing their finances and exploring available resources. By staying informed, seeking assistance when needed, and considering all options, homeowners can navigate through these difficult times and protect their investments. It is crucial to remember that with careful planning and sound financial decision-making, it is possible to weather the storm and emerge stronger on the other side.