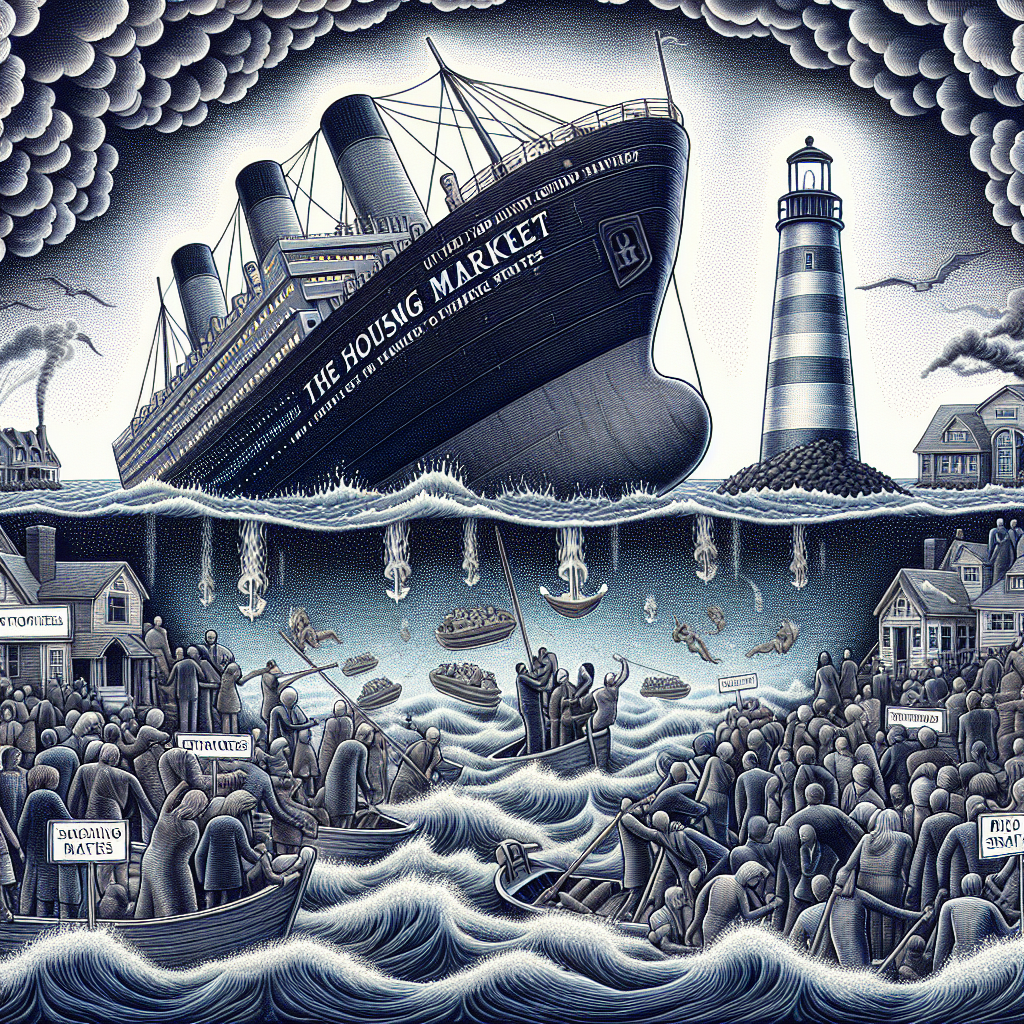

The US Housing Market is currently facing a crisis due to the rising mortgage rates, creating challenges for both homebuyers and homeowners. As interest rates increase, the cost of borrowing also goes up, making it harder for individuals to purchase homes or refinance existing mortgages. In this article, we will delve into the strategies that can help navigate the impact of rising mortgage rates in the US Housing Market.

Understanding the Impact of Rising Mortgage Rates

Rising mortgage rates have a significant impact on the housing market. Higher interest rates lead to increased monthly mortgage payments, reducing the purchasing power of potential buyers. For existing homeowners with adjustable-rate mortgages, rising rates can result in higher monthly payments, potentially causing financial strain.

Analyzing Market Trends and Forecasting Rates

To navigate the impact of rising mortgage rates, it is essential to stay informed about market trends and forecasts. Monitoring economic indicators, such as the Federal Reserve’s decisions on interest rates and the overall health of the economy, can provide valuable insights into future rate movements. By being proactive and informed, individuals can make informed decisions regarding their mortgage options.

Consider Refinancing Options

One strategy to mitigate the impact of rising mortgage rates is to explore refinancing options. Refinancing a mortgage at a lower rate can help lower monthly payments and save on interest costs over the life of the loan. It is important to compare different refinancing offers, consider closing costs, and assess the potential savings before deciding to refinance.

Locking In a Rate

When mortgage rates are on the rise, it may be beneficial to consider locking in a rate to secure a lower interest rate for a predetermined period. This can provide protection against potential future rate hikes and offer peace of mind to borrowers. However, it is essential to carefully evaluate the terms and conditions of rate lock agreements to ensure they align with your financial goals.

Exploring Alternative Mortgage Options

In a rising rate environment, exploring alternative mortgage options can be beneficial. Fixed-rate mortgages provide stability in monthly payments and protect homeowners from interest rate fluctuations. Additionally, government-backed loans, such as FHA and VA loans, may offer more flexible terms and lower down payment requirements, making homeownership more accessible in a high-rate environment.

Seeking Professional Guidance

Navigating the complexities of the US Housing Market during a mortgage crisis can be challenging. Seeking guidance from a financial advisor or mortgage professional can provide valuable insights and personalized recommendations based on individual financial circumstances. These experts can help evaluate mortgage options, assess affordability, and develop a comprehensive strategy for managing rising mortgage rates.

Creating a Financial Plan

Developing a comprehensive financial plan is essential for navigating the impact of rising mortgage rates. A well-thought-out budget that considers housing costs, savings goals, and emergency funds can help individuals weather financial uncertainties and make informed decisions. By having a clear financial roadmap, individuals can proactively manage their mortgage payments and adjust their financial strategy as needed.

Monitoring Market Conditions and Adjusting Strategies

As the US Housing Market continues to face challenges from rising mortgage rates, it is crucial to monitor market conditions and be prepared to adjust strategies accordingly. Keeping an eye on economic indicators, interest rate trends, and housing market forecasts can help individuals stay ahead of potential changes and make informed decisions about their mortgage options.

Conclusion

The rising mortgage rates in the US Housing Market present challenges for homebuyers and homeowners alike. By understanding the impact of rising rates, analyzing market trends, considering refinancing options, locking in a rate, exploring alternative mortgage options, seeking professional guidance, creating a financial plan, and monitoring market conditions, individuals can develop strategies to navigate the crisis successfully. With proactive planning and informed decision-making, individuals can overcome the challenges posed by rising mortgage rates and achieve their homeownership goals in a competitive market environment.