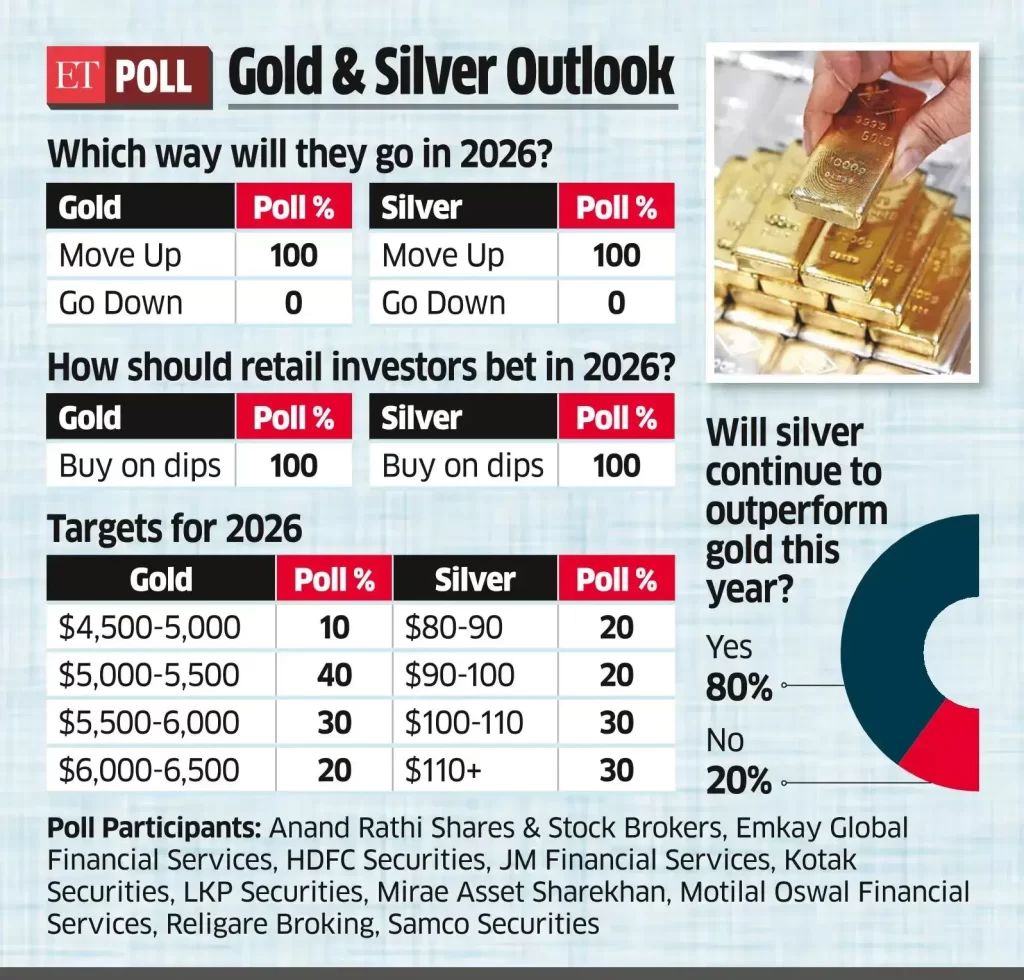

Gold prices recently surged past $4,900 per ounce, sparking significant attention and speculation regarding the future of this precious metal. Analysts suggest that this shocking surge could signal a transformative period for gold, with potential implications extending into 2026. Several factors have fueled this dramatic increase, including heightened geopolitical tensions, inflationary pressures, and a weakened U.S. dollar.

Investors are increasingly turning to gold as a safe haven asset amidst economic uncertainty. The metal’s historical role as a hedge against inflation remains a powerful draw, especially as central banks around the world continue to implement expansive monetary policies. Furthermore, growing interest in sustainable investment options is driving demand for responsibly sourced gold.

As the market reacts to these dynamics, many experts recommend keeping a close eye on gold, suggesting that this unprecedented elevation could redefine investment strategies and asset allocation in the coming years. As 2026 approaches, gold’s significance is likely to rise, attracting new interest from diverse sectors.

For more details and the full reference, visit the source link below: