The silver market is poised for intriguing shifts as we approach 2025, driven by a confluence of economic, industrial, and geopolitical factors. Analysts predict that the price of silver could experience significant volatility, potentially reaching new heights due to increasing demand in sectors like renewable energy and electronics. The shift toward sustainable technologies, particularly solar energy, is anticipated to elevate silver’s role as a critical component in photovoltaic cells.

Moreover, inflationary pressures and the current economic climate may push investors toward precious metals as a hedge against currency devaluation. The ongoing tensions in key mining regions could further disrupt supply, catalyzing price fluctuations.

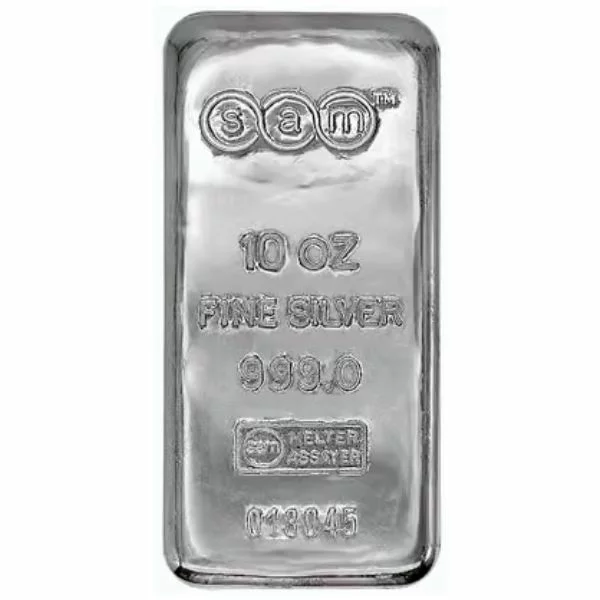

Market experts also point to the growing interest in silver as a form of investment, with retail purchases on the rise. As we look ahead, staying informed about global trends and shifts in investor sentiment will be crucial for predicting silver’s trajectory leading into 2025, making this a pivotal time for market stakeholders.

For more details and the full reference, visit the source link below: